Delving into Unit Personal Financial Literacy Homework 4 Answer Key, this comprehensive guide unlocks the secrets of financial empowerment, empowering individuals to navigate the complexities of personal finance with confidence. Rooted in sound financial principles, this answer key provides a roadmap to financial literacy, guiding readers towards a secure and prosperous financial future.

Exploring essential concepts ranging from budgeting and cash flow management to debt management, credit scores, investing, retirement planning, insurance, risk management, consumer protection, and real-world applications, this answer key serves as an invaluable resource for anyone seeking to master their personal finances.

Personal Financial Literacy Homework 4: Overview

Homework 4 focuses on essential concepts of personal financial literacy, empowering individuals to manage their finances effectively. It covers budgeting, cash flow management, debt management, investing, retirement planning, insurance, risk management, consumer protection, and scams.

The assignment aims to enhance students’ understanding of these key areas, equipping them with the knowledge and skills to make informed financial decisions throughout their lives.

Budgeting and Cash Flow Management

Budgeting involves creating a plan for allocating income to various expenses, ensuring financial stability and achieving financial goals. Effective budgeting techniques include the 50/30/20 rule, zero-based budgeting, and the envelope system.

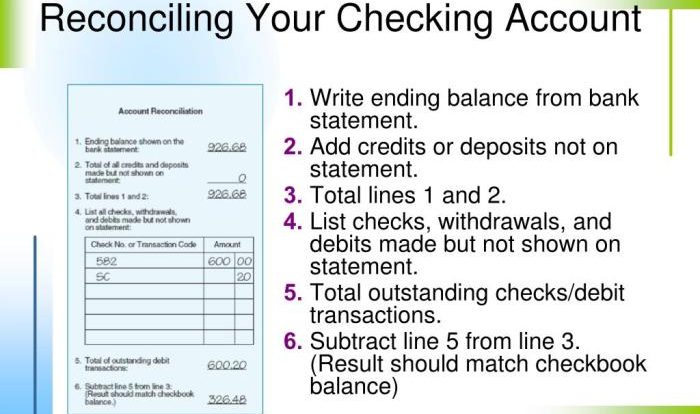

Cash flow management involves tracking the inflow and outflow of funds to ensure liquidity and avoid financial distress. A cash flow statement provides a snapshot of these cash flows, categorizing them as operating, investing, and financing activities.

Debt Management and Credit Scores

Debt refers to borrowed funds that must be repaid with interest. Different types of debt include credit card debt, personal loans, and mortgages. Effective debt management involves understanding the terms and conditions of debt, prioritizing high-interest debt, and creating a repayment plan.

Credit scores are numerical representations of an individual’s creditworthiness, based on factors such as payment history, credit utilization, and length of credit history. Improving credit scores involves paying bills on time, keeping credit utilization low, and avoiding excessive credit inquiries.

Investing and Retirement Planning: Unit Personal Financial Literacy Homework 4 Answer Key

Investing involves allocating funds to various assets, such as stocks, bonds, and mutual funds, with the potential to generate returns. Understanding the different types of investments and their risk-return profiles is crucial.

Retirement planning involves saving and investing for future financial security during retirement. Retirement account options include 401(k) plans, IRAs, and annuities. Compound interest plays a significant role in long-term investing, allowing investments to grow exponentially over time.

Insurance and Risk Management

Insurance provides financial protection against unexpected events, such as health emergencies, property damage, and liability. Different types of insurance include health insurance, life insurance, and property insurance.

Risk management involves identifying, assessing, and mitigating financial risks. Insurance is a key tool for risk management, as it transfers the financial burden of potential losses to an insurance company. Understanding deductibles and premiums is essential for effective insurance coverage.

Consumer Protection and Scams

Consumers have certain rights and responsibilities, including the right to fair and accurate information, the right to safety, and the right to choose. Common financial scams include phishing scams, pyramid schemes, and identity theft.

Government agencies, such as the Consumer Financial Protection Bureau (CFPB), play a crucial role in protecting consumers from financial exploitation and ensuring a fair marketplace.

Case Studies and Real-World Applications

Case studies provide real-life examples of personal financial literacy principles in action, showcasing the challenges and rewards of managing personal finances.

Students will analyze case studies and apply the concepts learned in Homework 4 to practical situations, demonstrating their understanding of personal financial literacy and its importance in everyday life.

FAQ Corner

What are the key concepts covered in Homework 4?

Homework 4 covers essential concepts such as budgeting, cash flow management, debt management, credit scores, investing, retirement planning, insurance, risk management, consumer protection, and real-world applications of personal finance principles.

How can I improve my credit score?

To improve your credit score, consider paying your bills on time, reducing your credit utilization ratio, and limiting the number of credit inquiries.

What is the importance of compound interest in investing?

Compound interest allows your investments to grow exponentially over time, as interest is earned not only on the initial investment but also on the accumulated interest.